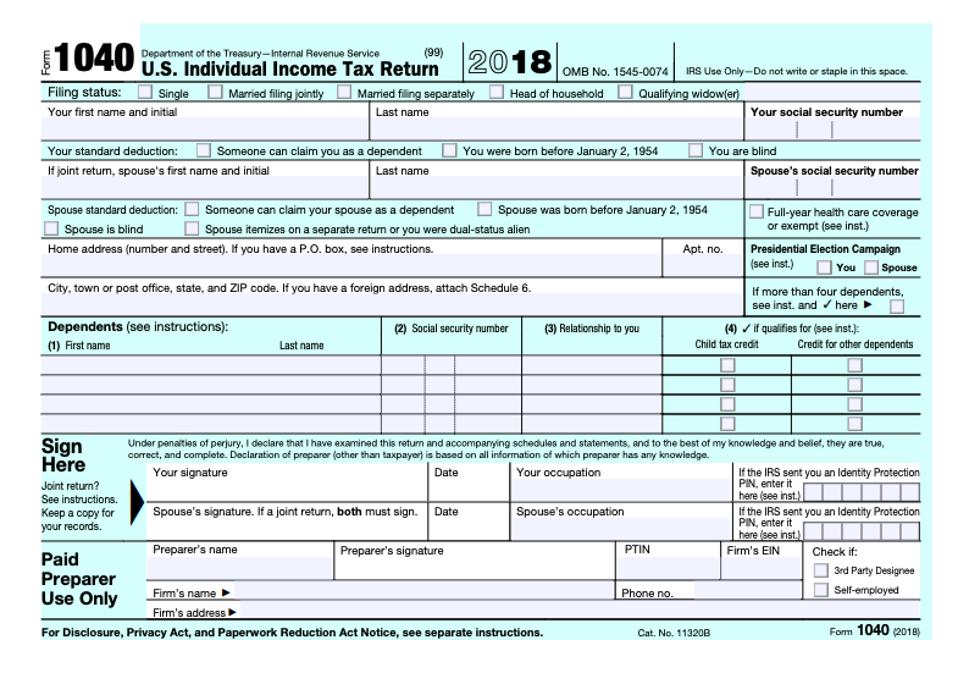

Irs 1040 Form

Irs 1040 Form. Rules governing practice before irs. 6 1040 tax form video by turbotax. It is the simplest form for individual federal income tax returns filed with the irs. Form 1040ez was meant to simplify the filing process for filers who had relatively simple tax situations. Irs form 1040ez was a shortened version of the irs tax form 1040.

Add required data, edit and save changes. By julie davoren updated march 28, 2017. 3 the previous 1040 forms and instructions: 5 when getting ready to fill out your tax forms. Form 1040 (officially, the u.s. Unlike form 1040a and 1040ez, both of which can only be used for. Also, if you're not a sole proprietor, you. Form 1040 is an official tax document used by individuals to file tax returns with the irs in the usa that should be submitted by the annual tax filing deadline each year, usually on april 15th.

The irs tax form 1040 schedule c is for the profit and loss from a sole propietorship.

Irs publishes or updates it every year. Complete form 1040 if your tax situation is complicated. Form 1040 is the standard federal income tax form people use to report income to the irs, claim tax deductions and credits the formal name of the form 1040 is u.s. There have been a few recent changes to the federal form 1040. Print, download or send documents. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Edit, sign and download forms all versions of annual tax return forms and necessary schedules filed by us citizens or residents. It is the simplest form for individual federal income tax returns filed with the irs. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Rules governing practice before irs. Form 1040 is how individuals file a federal income tax return with the irs. But confused with irs form 1040 and related schedule. The form 1040 is an official tax document made available by the irs and is required to be filled in by individuals to file their. Department of the treasury—internal revenue service.

By julie davoren updated march 28, 2017. Form 1040 is the standard federal income tax form people use to report income to the irs, claim tax deductions and credits the formal name of the form 1040 is u.s. Contacting your local irs office. The form 1040 is an official tax document made available by the irs and is required to be filled in by individuals to file their. It is the simplest form for individual federal income tax returns filed with the irs. Taxpayers to file an annual income tax return. Taxpayers to file their the 1040 form allows for quite a few deductions and exemptions, which can honestly make a great deal of. Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Rules governing practice before irs. Irs 1040 form is a necessary document that must be filled by all us citizens to declare their income for the year.

:max_bytes(150000):strip_icc()/ScreenShot2020-12-02at12.25.04PM-31c76162bb1b4ce18b1c3b83f1a9b7a9.png)

All the individuals and businesses are obliged to report their financial information to the irs in the end of a fiscal year.

Rules governing practice before irs. Form 1040 is how individuals file a federal income tax return with the irs. Irs form 1040 is used to report financial information to the internal revenue service of the united states. The basic form used for this is irs form 1040. Estimated tax payments now reported on line 26. Form 1040 is the standard federal income tax form people use to report income to the irs, claim tax deductions and credits the formal name of the form 1040 is u.s. Learn how much tax you owe or what your refund is 1040 form. Individual income tax return) is an irs tax form used for personal federal income tax returns filed by united states residents. Save or instantly send your ready documents. Unlike form 1040a and 1040ez, both of which can only be used for. 3 the previous 1040 forms and instructions: There have been a few recent changes to the federal form 1040. Previously, irs 1040 forms and instructions were sent by mail to all us taxpayers. Irs form 1040ez was a shortened version of the irs tax form 1040.

Form 1040 is an official tax document used by individuals to file tax returns with the irs in the usa that should be submitted by the annual tax filing deadline each year, usually on april 15th. This video goes over all of the parts of the 1040 form in detail giving you a glimpse of what is on the form so you know what to expect. Also, if you're not a sole proprietor, you. Complete form 1040 if your tax situation is complicated. Review the irs instructions for form 1040 for any other forms you need. The basic form used for this is irs form 1040. Form 1040 is how individuals file a federal income tax return with the irs. Form 1040ez was meant to simplify the filing process for filers who had relatively simple tax situations.

Also, if you're not a sole proprietor, you.

Although there is a standard form template, its variations can be changed according to the. We'll review the differences and show you how file 1040 form when it comes to tax time. Irs form 1040 comes in a few variations. Department of the treasury—internal revenue service. Unlike form 1040a and 1040ez, both of which can only be used for. Also, if you're not a sole proprietor, you. Rules governing practice before irs. Review the irs instructions for form 1040 for any other forms you need. Complete irs 1040 2019 online with us legal forms. Previously, irs 1040 forms and instructions were sent by mail to all us taxpayers. Form 1040 is how individuals file a federal income tax return with the irs. The basic form used for this is irs form 1040. Download form 1040 instructions (pdf). 5 when getting ready to fill out your tax forms.

Posting Komentar untuk "Irs 1040 Form"